The Facts About Gold Card Visa Uncovered

Some Ideas on Gold Card Visa You Need To Know

Table of ContentsThe Gold Card Visa IdeasNot known Factual Statements About Gold Card Visa The Definitive Guide to Gold Card VisaNot known Incorrect Statements About Gold Card Visa Some Known Incorrect Statements About Gold Card Visa Gold Card Visa Things To Know Before You BuyThe smart Trick of Gold Card Visa That Nobody is Discussing

Gold Card Visa for Dummies

In this situation, the limiting element on the amount of revenue a Gold Card might create is the number of candidates ready to pay this dealt with fee. According to price quotes from Knight Frank, a realty working as a consultant, there are concerning 1.4 million people living outside the USA with a total assets of a minimum of $10 million.

Congress ought to go even more and excuse all CBP projects from GSA's evaluation if it makes a decision to make use of the Gold Card Visa income for jobs at ports of entrance. Gold Card Visa financing can additionally be made use of to fix gaps in CBP staffing.

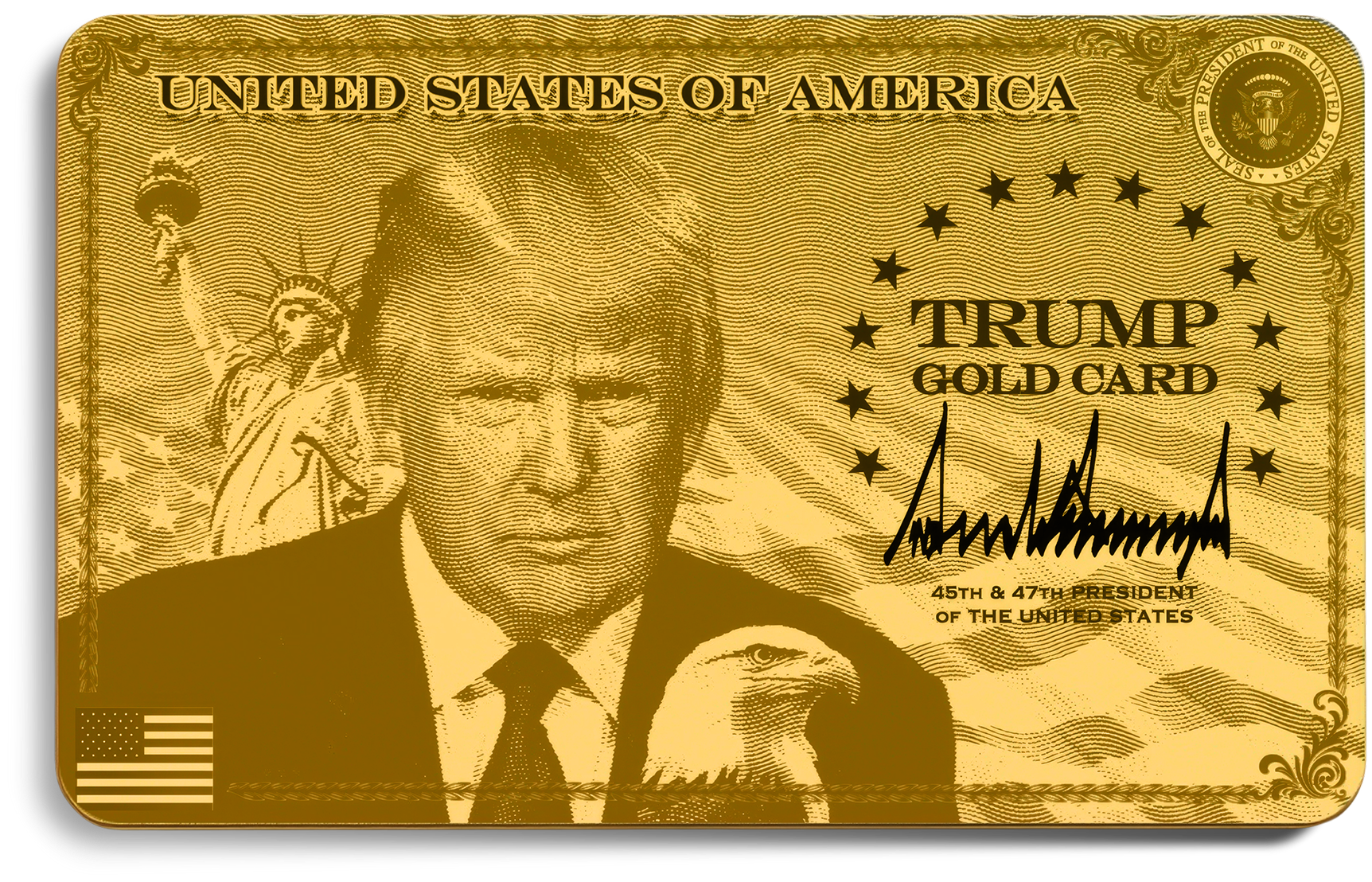

Today, President Donald J. Trump signed an Exec Order to create the Gold Card visa program, promoting expedited immigration for aliens who make considerable monetary gifts to the United States. The Order directs the Secretary of Commerce, in sychronisation with the Assistants of State and Homeland Safety and security, to establish a "Gold Card" program.

See This Report on Gold Card Visa

The Order instructs that these presents work as evidence of remarkable company capability and national advantage, accelerating adjudication consistent with lawful and security problems. The Order directs the Assistant of Commerce to transfer the presents right into the Treasury and utilize them to advertise business and American sector. The Order calls for the Secretaries to take all needed and ideal steps to execute the Gold Card program, including establishing application procedures, charges, and possible growths to various other visa groups.

Head of state Trump is working relentlessly to reverse the dreadful policies of the Biden Administration to drive extraordinary investments to America. Early in his 2nd term, President Trump recommended Gold Cards, a vision he is now providing to draw in well-off investors and business owners. President Trump's steady dedication to revitalizing American industry has spurred trillions of bucks in international investment pledges.

Paired with the simultaneously-issued Presidential Proclamation labelled "Restriction on Entrance of Particular Nonimmigrant Employees" on the H-1B Program needing companies to pay $100,000 per H-1B request (see Saul Ewing's summary right here), there is much conjecture concerning the Gold Card Program. While the Gold Card Program has yet to be passed, many questions continue to be taking into account the issuance of the Executive Order.

Gold Card Visa Things To Know Before You Buy

income." The Gold Card and the Platinum Card therefore appear to be created to operate within Congressionally-authorized visa procedures and do not, as expected, produce a new visa program that was not previously approved by Congress. It is feasible, nevertheless, that there will certainly be difficulties to the Gold Card Program questioning concerning whether Congressional intent in authorizing the EB-1 Program and the EB-2 Program website is shown by the Exec Order.

Another point that remains vague is whether specific applicants can include their by-products in the contribution amount; that is, does the needed donation amount ($1 million for the Gold Card and $5 million for the Platinum Card) use to only the applicant or rather apply to the candidate, as well as the applicant's partner and any of their kids under the age of 21? If the former, after that a household of four would certainly require to donate $4 million for the Gold Card and $20 million for the Platinum Card.

This concern will need to be resolved in any type of final activity taken in ordering the Gold Card Program. An additional vague subject connects to the vetting that would certainly be carried out under the Gold Card Program. Under the EB-5 Program, each candidate and, extra notably, each candidate's resource of funds, goes through an incredibly in-depth forensic evaluation.

How Gold Card Visa can Save You Time, Stress, and Money.

The IPO would certainly be the most sensible unit to administer the Gold Card Program, given its experience in providing the EB-5 Program; nevertheless, including the burden of carrying out the Gold Card Program to the IPO would likely decrease adjudications for the EB-5 Program. Another factor to consider associates with the tax obligation therapy for candidates for the Gold Card and the Platinum Card.

The initiative by the Management shows up to be to draw in such people to spend in the U.S. by getting a Platinum Card. How the tax exception will be accomplished without a change of the United state

Ultimately, eventually is important to vital the Administration's management in purposes with the Gold Card Program.

The new program would certainly serve as methods to satisfy the "phenomenal capacity" requirements of the existing EB-1 and EB-2 visa pathways for aliens with amazing or remarkable capacity. Added assistance is expected, as the EO additionally purchased the Assistant of Business, the Assistant of State and the Secretary of Homeland Security to take all essential and suitable actions to apply the Gold Card within 90 days of the order.

irreversible residents and citizens are presently based on united state taxes and reporting on their worldwide income. This implies that united state permanent homeowners and people have to pay government earnings taxes on earnings made outside the United States. The Management did, however, also mean a Platinum Card for a $5 million monetary payment that would "permit individual applications to live in the USA for approximately 270 days annually without going through tax obligation on non-U.S.

people and irreversible homeowners, as these Platinum Card recipients would have the ability to invest a majority of their time in the USA without undergoing income tax obligations on their international revenue. This program is not yet readily available however is apparently in the works; Lutnick suggested that the program would require congressional approval prior to they could formally release the $5 million-per-applicant program.